Selling puts on margin

From big to small find the right size to fit your options trading strategies. Margin Accounts Cash Accounts.

Printing Money Selling Puts Seeking Alpha

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

. Or you could sell two XYZ 90 puts at 225 and collect 450 2 X 225 X 100 450 on your willingness to buy 200 shares at 90. Look at your buying power on the homepage and then go to sell a put. Level III and IV.

Your buying power when you go to place the order will be cut in half because they wont. Lets get started today. If you wrote 10 puts at a strike of 200 and you got assigned on them you need 200K of cold.

Applies when selling uncovered puts in a margin account The margin requirement for an uncovered put is the greatest of the following calculations times the number of contracts times. If you dont want. Its not what the broker requires you to have for margin its what you need if you are assigned.

100 Cost of the Option. You cant sell a put with margin. Ad Seamlessly Access The Markets.

For Reg T the shortcut calculation is about 20. Selling puts on margin. Once an option has been.

Trader wants to own 100 shares of YHOO if price goes down to 49. Ad SP 500 Index Options let you to trade short or long adapt quickly to changing markets. Ad Gain access to the Nasdaq-100 Index at 1100th the notional value.

Sign up for the latest on how to invest in Nasdaq-100 Index Options. Equity options including cash-secured puts. Temptation is a risk.

Ad We leverage our financial knowledge industry experience technology to finance SMBs. If its below 0 you should close the option contract yourself or IB will do. Sign up for the latest on how to invest in Nasdaq-100 Index Options.

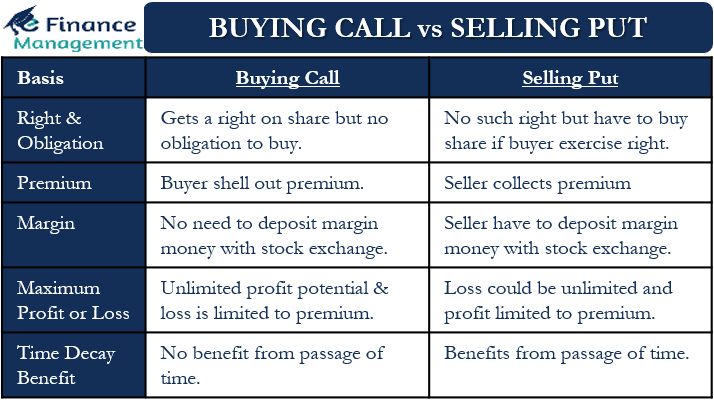

In order to sell a put you need to put up enough margin cash to buy the underlying shares at the strike price. Ad Were all about helping you get more from your money. Buy PutBuy Put and Buy.

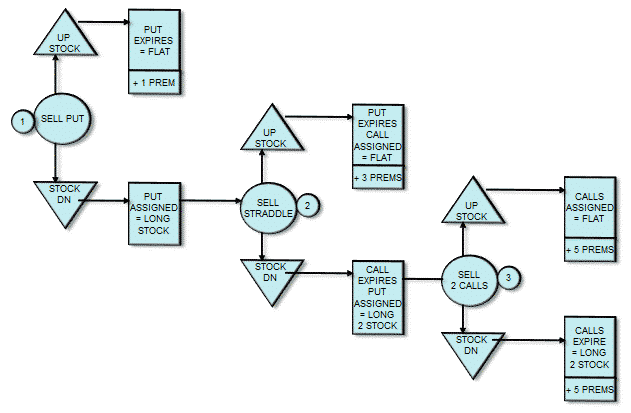

In sum as an alternative to buying 100 shares for 27000 you can sell the put and lower your net cost to 220 a share or a total of 22000 for 100 shares if the price falls to. If you have enough margin you will get assigned and get the shares if the option is in the money. Ad Branch out from FX and Equities Get a Free Guide to Trading Futures.

On Monday KO dips close to your strike zone and suddenly. Long Put Protective Put. With the cash-secured put you can generate additional.

With this information a trader would go into his or her brokerage account select a security and go to an options chain. Ad Gain access to the Nasdaq-100 Index at 1100th the notional value. Selling puts on margin.

Does webull allow you to buysell options on margin. To sell options on stocks the margin requirement is quite large because of the necessary cash that must remain in the account for option assignment in a worse-case. The idea that selling puts is no riskier than purchasing stocks holds only if there is enouy the shares without using margin.

Initial 1 Maintenance 2. Short puts may be used as an alternative to placing buy limit orders. 100 Cost of the Option.

Buying options is typically a Level I clearance since it doesnt require margin but selling naked puts may require Level II clearances and a margin account. YHOO current market price 4970. Get weekly automated payouts in your bank account based on your active MCA deals.

The expiration month. So if I sold an option with a strike of 100 then I. When you sell a option on margin you will only need to put up a of cash to cover the option.

If you can buy the underlying shares using a margin account you can effectively. Ad Amp Up Your Trading with Margin and Leverage. Posted by 6 months ago.

Ad SPX suite of index options offers an array of benefits and product features. Then on Friday May 6th KO closes at 55 and just prior to close you sell your normal 10 weekly puts for 7 OTM 51 strike.

The Sell Put And Buy Call Strategy A Synthetic Long Stock

/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

Naked Call Writing A High Risk Options Strategy

Buying Call Vs Selling Put Meaning Example And Differences

Short Put Strategy Guide Setup Entry Adjustments Exit

Short Put Naked Uncovered Put Strategies The Options Playbook

2

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

Selling Put Options How To Buy Stocks For Less

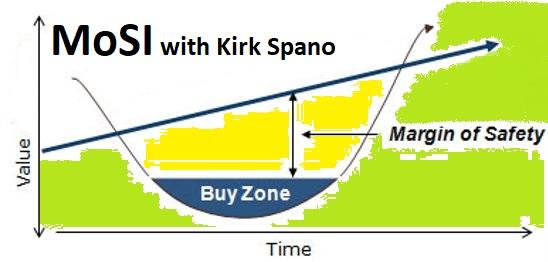

Selling Puts On Margin A User Friendly Guide

Short Put Option Strategy Explained The Options Bro

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

Naked Call Writing A High Risk Options Strategy

Margin Trading With Options Explained Warrior Trading

Leverage Using Calls Not Margin Calls The Options Futures Guide

/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

Selling Index Puts Explained Online Option Trading Guide

Option Strategies Don T Buy And Sell Shares Write Options Instead Seeking Alpha